Contents

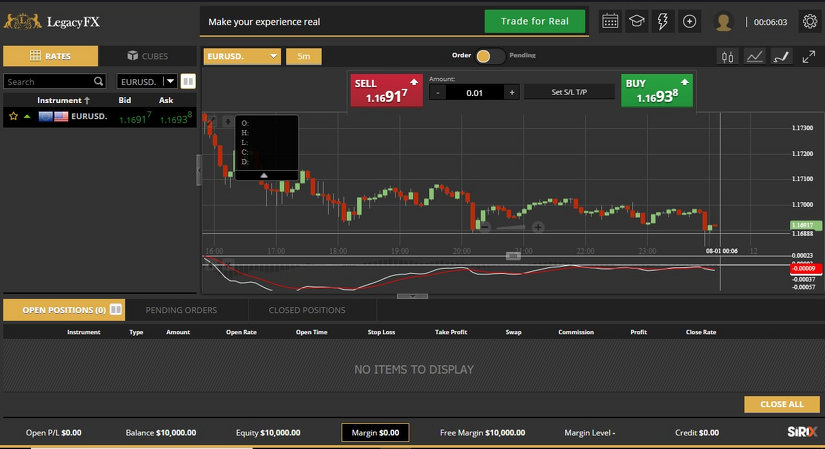

They are visually more appealing and easier to read than the chart types described above. The upper portion of a candle is used for the opening price and highest price point used by a currency, and the lower portion of a candle is used to indicate the closing price and lowest price point. A down candle represents a period of declining prices and is shaded mfx broker red or black, while an up candle is a period of increasing prices and is shaded green or white. Much like other instances in which they are used, bar charts are used to represent specific time periods for trading. Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade.

Many individuals who started trading Forex as a part-time job ended up leaving their jobs to concentrate on trading forex because they received better profits than they expected. To begin with, you have to keep your risk very small for each trade, and 1% or less is usual. That may seem tiny, but losses add up, and strings of losses can be seen even in a successful day-trading strategy. It is not the place to put any money that you cannot afford to lose, such as retirement funds, as you can lose most or all it very quickly. The CFTC has witnessed a sharp rise in forex trading scams in recent years and wants to advise you on how to identify potential fraud.

The official rate itself is the cost of one currency relative to another , as determined in an open market by demand and supply for them. It is the amount of one currency that an FX dealer pays or spends to get one unit of another currency in formal trading of the two currencies. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price. As a result, currencies tend to reflect the reported economic health of the country or region that they represent.

Diversification does not eliminate the risk of experiencing investment losses. Not investment advice, or a recommendation of any security, strategy, or account type. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market. Forex trading offers constant opportunities across a wide range of FX pairs. FXTM’s comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge.

Once they’ve failed, you’ll hear various excuses such as, ‚the market is rigged and fraudulent.‘ The truth is that stocks and other markets are traded in very similar ways, the difference is the effect of using leverage. One thing that really adds to the fun is that forex brokers offer forex leverage to help you in your trading. Trading with leverage is basically the forex broker allowing you to trade more on the market than what you actually have in your account. This is an advantage for them because they collect fees based on the size of the trades that you make. Every time you make a trade with a forex broker they collect what they call the spread, which is a tiny piece of your trade. Foreign exchange trading is essentially the trading of the currency from two countries against each other.

In reference here is FX procured outside sales by the Central Bank in countries that have administered foreign exchange policies. The risk management implication is that banks should adhere strictly to FX regulations and endeavor to operate within regulatory requirements and guidelines at all times. Critical issues often border on documentation, disclosure, and reporting requirements for FX sources and transactions. Individual retail speculative traders constitute a growing segment of this market.

Asian markets rise despite rate

Because of the low account requirements, round-the-clock trading, and access to high volumes of leverage, the global forex market is appealing to many traders. Is where participants come to buy and sell foreign currencies (e.g., foreign exchange rates, currencies, etc.). Foreign exchange trading occurs around the clock and throughout all global markets. It is the only truly continuous and nonstop trading market in the world, with participants trading day and night, weekday and weekend, and on holidays. It has also been described as the intersection of Wall Street and Main Street.

While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad. If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1). Stay informed with real-time market insights, actionable trade ideas and professional guidance. Take control of your trading with powerful trading platforms and resources designed to give you an edge.

How much do currency traders make a year?

The annual salary of a forex trader is broad. For the top traders, annual salaries amount to over $150,000, yet the lowest salaries can be around $11,500. According to Indeed, the average salary of a forex trader is $98,652 per year plus $25,000 in commissions.

It is already mentioned, but it’s important to stress that investing in foreign currencies is very risky. Be sure that if things don’t go as expected, it’s lexatrade login money you can afford to lose. You can rely on business guidance, financial reports, and other data to forecast the future while investing in U.S. stocks.

Hong Kong Spends $722 Million to Defend Currency Peg

The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information contained in a trend line to identify breakouts or a change in trend for rising or declining prices. The blender company could have reduced this risk by short selling the euro and buying the U.S. dollar when they were at parity. That way, if the U.S. dollar rose in value, then the profits from the trade would offset the reduced profit from the sale of blenders. If the U.S. dollar fell in value, then the more favorable exchange rate would increase the profit from the sale of blenders, which offsets the losses in the trade. For example, EUR/USD is a currency pair for trading the euro against the U.S. dollar.

Asian stock markets were mostly higher Tuesday as investors braced for another sharp interest rate hike by the Federal Reserve to cool inflation. Open a brokerage account; you need a place to store your foreign currency first. If you do not have a favorite brokerage already, open one to get started. To begin with, deposit cash from a related check or another brokerage account to finance your account.

There are standard, mini, micro, and nano lots, which consist of 100,000, 10,000, 1,000, and 100 currency units, respectively. The forex market is by far one of the most liquid of the global asset markets. Many or all of the offers on this site are from companies from which Insider receives compensation .

Ready to learn about forex?

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited from the change in value. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world. Unlike the spot market, the forwards, futures, and options markets do not trade actual currencies.

From 1970 to 1973, the volume of trading in the market increased three-fold. At some time (according to Gandolfo during February–March 1973) some of the markets were „split“, and a two-tier currency market was subsequently introduced, with dual currency rates. Factors likeinterest rates, trade flows, tourism, economic strength, andgeopolitical risk affect the supply and demand for currencies, creating daily intertrader demo volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency’s value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs. The foreign exchange market plays a large part in making international trade possible.

Client contact increases across the board and salary, bonus, and account reviews happen every six to twelve months. Hours increase, but personal styles and the wealth of experience each person has accrued makes the job more enjoyable and less frantic. For example, a person could exchange the US dollar for the Japanese Yen.

We may choose to leave our principal position unhedged or partially hedged, and may adjust any hedge from time to time in our sole discretion. In order to unwind a hedge, we may need to unwind our principal position by trading in the relevant or related instruments. Regardless of whether or how we choose to hedge, any profit or loss resulting from any hedging activity will accrue solely to Morgan Stanley. In this lesson summary review and remind yourself of the key terms and graphs related to the market for foreign exchange .

A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. The tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. A similar edge provided by converging technical indicators arises when various indicators on multiple time frames come together to provide support or resistance.

The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose.

Currency Converter

These are not standardized contracts and are not traded through an exchange. A deposit is often required in order to hold the position open until the transaction is completed. On 1 January 1981, as part of changes beginning during 1978, the People’s Bank of China allowed certain domestic „enterprises“ to participate in foreign exchange trading. Sometime during 1981, the South Korean government ended Forex controls and allowed free trade to occur for the first time. During 1988, the country’s government accepted the IMF quota for international trade. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants.

One of the leading non-banking asset managers in the Argentinian market, we specialize in fixed, flexible and variable income funds, offering asset management solutions for a variety of investors. We provide liquidity in global equities to clients via two offerings that suit the way you want to trade. StoneX Commodity Solutions trades physical commodities including fats and oils, grains and feed ingredients, coffee, cocoa, cotton and lumber.

Due to less notice, forex markets will take major swings in a short amount of time. First, news spreads rapidly among forex traders, with high volatility, and these markets tend to move quickly. Forex markets are often more volatile-which means they can change rapidly and unpredictably, than markets for stocks and bonds. Forex markets are open most of the time, compared to the stock market that has set hours.

As will be seen in the case of Japan Airlines below, the risk can be high. The most popular forex market is the euro to US dollar exchange rate , which trades the value of euros in US dollars. A forex dealer may be compensated via commission and/or mark-up on forex trades.

Forex Trading: A Beginners Guide

Recent micro-based research moves away from the traditional partial equilibrium domain of microstructure models to focus on the link between currency trading and macroeconomic conditions. This research aims to provide the microfoundations of the exchange rate dynamics that have been missing in general equilibrium macro models. Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit.

Access charting packages that are optimized for forex trading, currency trading maps, and real-time breaking news from CNBC International, all from one integrated platform. You’ll get access to advanced order types and an economic calendar to highlight when US economic events occur. Foreign exchange, better known as “forex,” is the largest financial market in the world. This marketplace for all the world’s currencies has many potential benefits.

How can I make money fast in forex?

The way to make money fast in forex, is to understand the power of compound growth. For example, if you target 50% a year in your trading, you can grow an initial $20,000 account, to over a million dollars, in under 10 years. Break the norm, and gain more.

This makes forex trading a strategy often best left to the professionals. Similarly, traders can opt for a standardized contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. This is done on an exchange rather than privately, like the forwards market.

The three most popular charts in trading

Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Countries such as South Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls. Perhaps it’s a good thing then that forex trading isn’t so common among individual investors. In fact, retail trading (a.k.a. trading by non-professionals) accounts for just 5.5% of the entire global market, figures from DailyForex show, and some of the major online brokers don’t even offer forex trading. Like any other market, currency prices are set by the supply and demand of sellers and buyers. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question.

What is Forex?

Conversely, if the euro goes down with respect to the dollar, you could lose your entire deposit, or even more. If the euro goes go up and you’d like to take your profits, you would “unwind” that position by selling the euro and buying the dollar. That’s a very simple example, but should give you a general idea of how forex works.

Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros, even though its income is in United States dollars. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies.